Bitcoin Overview

- Daily spot trading volume: $846.0 million, 30 day average spot: $588.8 million.

- Total futures notional: $202.1 million.

- The top five traded coins were, respectively, Tether (↑0.0%), Bitcoin (↑3.4%), Ethereum (↑8.9%), USD Coin (↓0.01%), Solana (↑5.4%).

- Strong returns from iExec (↑43%), Injective Protocol (↑24%), and Lido DAO (↑19%).

| August 10, 2022 $846.0M traded across all markets today Crypto, EUR, USD, JPY, CAD, GBP, CHF, AUD |

||||

|---|---|---|---|---|

| USDT $1.00 ↑0.0% $254.0M |

BTC $23958.80 ↑3.4% $212.2M |

ETH $1853.82 ↑8.9% $211.7M |

USDC $1.00 ↓0.01% $67.2M |

SOL $42.49 ↑5.4% $15.2M |

| DOT $9.52 ↑7.0% $13.0M |

ADA $0.54 ↑4.8% $10.8M |

DAI $1.00 ↓0.0% $7.01M |

LINK $9.06 ↑3.6% $6.07M |

ATOM $11.97 ↑5.1% $5.44M |

| MATIC $0.94 ↑5.1% $4.98M |

XRP $0.38 ↑3.7% $4.6M |

AVAX $29.19 ↑6.5% $4.14M |

LTC $61.63 ↑4.1% $3.75M |

XMR $167.53 ↑5.7% $3.54M |

| ETC $38.62 ↑5.8% $3.18M |

UNI $9.22 ↑9.0% $2.93M |

DOGE $0.07 ↑3.4% $2.82M |

KAVA $2.30 ↑3.9% $2.04M |

AAVE $111.21 ↑14% $2.03M |

| KSM $62.92 ↑4.4% $1.76M |

APE $7.12 ↑1.5% $1.74M |

FIL $8.30 ↑3.2% $1.72M |

BCH $142.24 ↑5.9% $1.66M |

CRV $1.39 ↑7.5% $1.59M |

| FLOW $3.06 ↑2.5% $1.51M |

ZEC $78.74 ↓1.2% $1.47M |

SHIB $0.00001 ↑3.1% $1.37M |

WAVES $6.10 ↑5.4% $1.18M |

SC $0.005 ↑7.5% $1.16M |

| NEAR $5.88 ↑9.6% $959K |

MINA $0.98 ↑2.1% $956K |

ALGO $0.36 ↑5.5% $953K |

MANA $1.07 ↑5.3% $921K |

XTZ $1.87 ↑4.2% $872K |

| SAND $1.34 ↑4.0% $774K |

EOS $1.28 ↑8.7% $773K |

SNX $4.20 ↑10.0% $677K |

XLM $0.13 ↑3.0% $639K |

LUNA $0.00010 ↑1.9% $635K |

| ICP $8.33 ↑6.5% $590K |

LRC $0.46 ↑3.5% $577K |

PAXG $1787.90 ↓0.19% $552K |

LDO $2.70 ↑19% $544K |

COMP $66.38 ↑14% $517K |

| FTM $0.41 ↑8.7% $503K |

QNT $126.92 ↑1.2% $495K |

GRT $0.15 ↑4.4% $467K |

TRX $0.07 ↑2.8% $403K |

BAT $0.46 ↑6.8% $395K |

| COTI $0.12 ↑8.1% $328K |

RUNE $2.93 ↑8.8% $305K |

DYDX $2.45 ↑5.0% $296K |

INJ $1.86 ↑24% $291K |

DASH $54.65 ↑3.7% $268K |

| MLN $29.82 ↑10% $256K |

PERP $1.10 ↑10% $252K |

NANO $1.07 ↑3.5% $234K |

GALA $0.06 ↑6.5% $228K |

SUSHI $1.57 ↑10% $221K |

| ICX $0.35 ↑6.9% $220K |

OCEAN $0.23 ↑6.7% $214K |

AXS $18.47 ↑5.2% $209K |

EWT $2.73 ↑7.9% $209K |

BADGER $5.30 ↑5.2% $201K |

| GLMR $0.77 ↑7.5% $198K |

STORJ $0.72 ↑8.3% $194K |

CHZ $0.15 ↑5.8% $185K |

MKR $1109.20 ↑3.5% $168K |

UST $0.029 ↓0.6% $166K |

| GNO $179.61 ↑10% $165K |

REN $0.18 ↑1.4% $162K |

SPELL $0.002 ↓8.4% $158K |

YFI $11376.00 ↑2.4% $143K |

API3 $2.05 ↑4.9% $142K |

| RNDR $0.73 ↑2.8% $133K |

RLC $1.47 ↑43% $129K |

SCRT $1.28 ↑3.7% $128K |

MOVR $17.70 ↑4.9% $126K |

CTSI $0.19 ↑9.9% $126K |

| OXT $0.13 ↑3.0% $126K |

ENS $16.09 ↑4.9% $126K |

LUNA2 $2.02 ↑2.1% $125K |

ANT $2.23 ↑5.8% $123K |

EGLD $67.02 ↑7.8% $123K |

| KNC $1.62 ↑7.7% $116K |

IMX $1.12 ↑1.9% $105K |

QTUM $4.19 ↑3.9% $102K |

KEEP $0.19 ↑3.7% $99.3K |

LPT $12.14 ↑8.1% $87.9K |

| SGB $0.026 ↑4.0% $84.6K |

ENJ $0.70 ↑4.2% $84.1K |

OMG $2.39 ↑4.4% $78.9K |

LSK $1.22 ↑3.8% $78.4K |

ZRX $0.37 ↑6.7% $77.3K |

| KILT $0.56 ↑4.6% $70.7K |

ANKR $0.035 ↑12% $70.6K |

1INCH $0.88 ↑8.5% $65.3K |

INTR $0.13 ↑8.0% $65.1K |

GMT $0.98 ↑3.3% $65.0K |

| JUNO $6.02 ↑3.9% $64.3K |

BAL $6.40 ↑7.6% $56.3K |

RARI $3.24 ↑0.14% $50.9K |

OGN $0.23 ↑6.1% $42.8K |

PSTAKE $0.22 ↑19% $41.8K |

| REP $8.90 ↑1.0% $36.9K |

KP3R $156.40 ↑5.9% $34.7K |

SBR $0.004 ↓3.7% $33.0K |

MIR $0.23 ↑3.1% $33.0K |

BTT $0.00000 ↑5.1% $32.4K |

| NYM $0.44 ↑11% $31.6K |

GST $0.06 ↑8.6% $30.7K |

FXS $7.02 ↑1.2% $29.7K |

GHST $1.35 ↑0.9% $28.9K |

JASMY $0.010 ↑4.2% $27.9K |

| SAMO $0.015 ↑6.2% $27.8K |

FORTH $5.29 ↓3.8% $27.6K |

STEP $0.041 ↑0.7% $27.4K |

ACA $0.32 ↑1.5% $27.1K |

CQT $0.09 ↑7.1% $26.7K |

| MV $0.20 ↓8.6% $26.7K |

BAND $1.85 ↑4.7% $22.5K |

RBC $0.13 ↑5.5% $21.7K |

SRM $1.02 ↑5.4% $19.8K |

BOND $8.33 ↑0.6% $19.7K |

| AUDIO $0.37 ↑4.1% $19.5K |

CVX $7.72 ↑9.2% $18.5K |

KAR $0.64 ↑3.7% $17.9K |

NMR $21.13 ↑0.9% $17.7K |

REPV2 $8.89 ↑3.6% $17.6K |

| KINT $2.97 ↑6.9% $17.2K |

KEY $0.005 ↑6.4% $15.7K |

MULTI $6.49 ↑8.1% $15.2K |

MSOL $43.92 ↑2.9% $14.9K |

WBTC $23919.30 ↑3.3% $14.2K |

| FET $0.10 ↑4.6% $13.9K |

TVK $0.06 ↑2.2% $12.1K |

BNT $0.61 ↑2.9% $10.9K |

SDN $0.36 ↑6.5% $10.2K |

RAD $2.60 ↓0.4% $9.89K |

| ASTR $0.050 ↑4.9% $9.81K |

PHA $0.13 ↑5.1% $9.76K |

GARI $0.08 ↑0.4% $8.86K |

RAY $0.86 ↑3.6% $8.56K |

ALCX $33.05 ↓0.7% $7.35K |

| AKT $0.41 ↓0.4% $7.28K |

TEER $0.77 ↓1.8% $7.23K |

POWR $0.26 ↑4.2% $7.2K |

DENT $0.001 ↑5.6% $6.86K |

LCX $0.06 ↑2.0% $6.75K |

| MXC $0.07 ↑6.9% $6.63K |

FIDA $0.53 ↑2.5% $6.6K |

ATLAS $0.008 ↑5.0% $6.42K |

PLA $0.45 ↑6.4% $6.42K |

MASK $1.80 ↑8.8% $6.41K |

| MC $0.93 ↑2.0% $6.12K |

OXY $0.06 ↑2.0% $5.52K |

WOO $0.25 ↑6.6% $5.26K |

BIT $0.75 ↑5.6% $5.14K |

KIN $0.00001 ↑2.0% $5.12K |

| IDEX $0.09 ↑2.7% $5.09K |

ACH $0.016 ↑4.3% $4.8K |

CFG $0.32 ↑6.7% $4.6K |

CVC $0.17 ↑8.2% $4.4K |

BICO $0.65 ↑6.0% $4.38K |

| ARPA $0.044 ↑3.9% $4.3K |

TOKE $1.87 ↓1.6% $4.25K |

BNC $0.23 ↑9.4% $4.22K |

ORCA $1.00 ↑4.8% $4.2K |

ALICE $2.85 ↑4.5% $4.18K |

| UMA $3.10 ↑5.6% $3.93K |

YGG $0.79 ↑5.8% $3.85K |

SUPER $0.18 ↑3.6% $3.77K |

XRT $4.46 ↓4.7% $3.69K |

CHR $0.24 ↑11% $3.31K |

| RARE $0.31 ↑6.0% $3.09K |

CSM $0.009 ↑0.0% $2.61K |

AIR $0.022 ↑2.5% $2.2K |

UNFI $9.22 ↓0.29% $1.64K |

POLIS $0.60 ↑6.2% $1.62K |

| MNGO $0.05 ↑6.8% $1.49K |

TLM $0.032 ↑3.9% $1.37K |

GTC $3.04 ↑7.3% $0.89K |

FARM $62.69 ↑0.0% $0.64K |

TBTC $25786.30 ↑1.9% $0.48K |

| TRIBE $0.16 ↑1.4% $0.39K |

AGLD $0.44 ↑0.6% $0.24K |

ADX $0.20 ↑5.0% $0.19K |

REQ $0.13 ↑0.0% $0.03K |

T $0.041 ↑1.0% $0.02K |

#####################. Trading Volume by Asset. ##########################################

Bitcoin Trading Volume by Asset

The figures below break down the trading volume of the largest, mid-size, and smallest assets. Cryptos are in purple, fiats are in blue. For each asset, the chart contains the daily trading volume in USD, and the percentage of the total trading volume. The percentages for fiats and cryptos are treated separately, so that they both add up to 100%.

Figure 1: Largest trading assets: trading volume (measured in USD) and its percentage of the total trading volume (August 10 2022)

Figure 2: Mid-size trading assets: (measured in USD) (August 10 2022)

###########. Daily Returns. #################################################

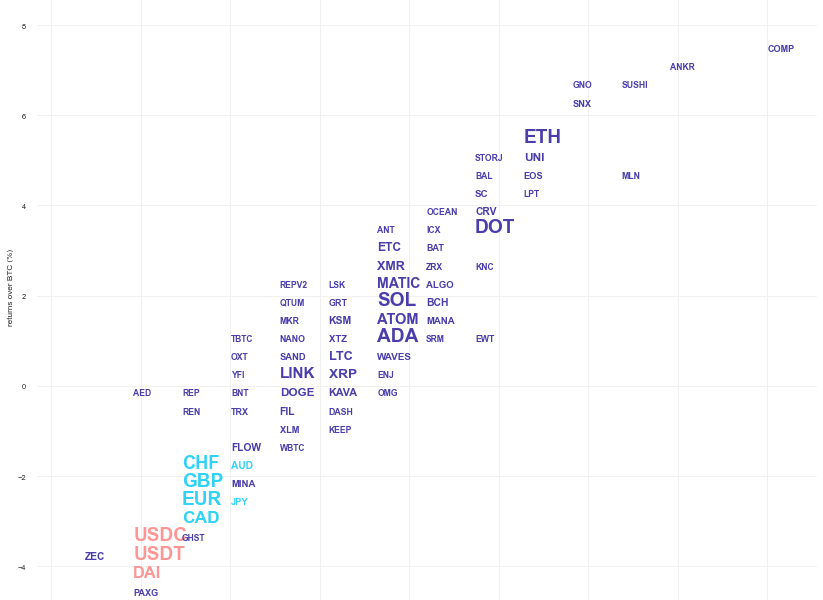

Bitcoin Daily Returns %

Figure 3: Returns over USD and XBT. Relative volume and return size is indicated by the size of the font. (August 10 2022)

###########. Disclaimer #################################################

The values generated in this report are from public market data distributed from Kraken WebSockets api. The total volumes and returns are calculated over the reporting day using UTC time.