Bitcoin miner’s stock slides on bankruptcy fears

A major publicly-traded crypto mining operator says its cash reserves might not last for long, alarming investors about its solvency. The firm warned that it could, among other things, file for bankruptcy.

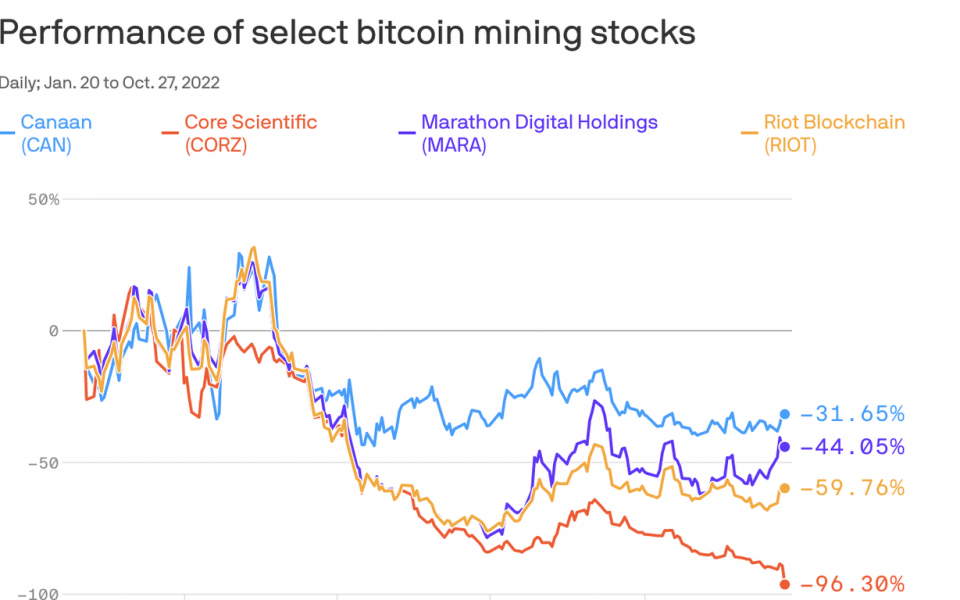

Driving the news: Shares of Core Scientific plunged roughly 75% Thursday morning to a low of about 25 cents, making it the year’s biggest loser of major publicly-traded U.S. bitcoin miners.

What’s happening: Core Scientific said that the combination of depressed bitcoin prices and heightened electricity costs, plus the ongoing litigation with Celsius Network, has rendered it unable to make debt payments.

- “The Board has decided that the Company will not make payments coming due in late October and early November 2022 with respect to several of its equipment and other financings, including its two bridge promissory notes,” the filing showed.

- The firm is also working to reduce monthly costs, delay construction expenses, spending and trying to increase hosting revenues.

Axios’ emailed query to Core Scientific went unanswered.

The big picture: Core Scientific’s bitcoin sales do not appear to have stemmed the bleed. The firm made waves in July when it sold almost all of its bitcoin holdings, with CEO Mike Levitt pointing to the market rout.

- He said then: “Our company has successfully endured downturns in the past, and we are confident in our ability to navigate the current market turmoil.”

- The firm continued to sell in August and September, per its monthly statements. Levitt appeared sanguine as recent as its early October update.

- “I am proud of our team’s resilience, adaptability and dedication in the face of difficult industry conditions,” he said.

Context: This is a tough time across the board for miners because, even as the price of bitcoin falls, more mining machines are coming online than ever before (as rising bitcoin difficulty shows), decreasing the profitability of existing operations.

Flashback: Core Scientific listed on the Nasdaq on Jan. 20 after closing its SPAC merger with Power & Digital Infrastructure Acquisition Corp.

- It was also one of the rare deals that had few investors asking for their money back, with roughly 35% of shares redeemed while others were seeing refund rates of 80% or more.

Of note: Core Scientific is locked in a battle with the now-bankrupt crypto lender Celsius Network over unpaid bills and services.

- That relationship predates Core Scientific’s public listing.

- Dig into the super 8-K filing related to Core Scientific’s SPAC merger documents and you’ll find that the bitcoin miner entered into an equipment lending agreement with Celsius Networks Lending in Nov. 2020.

What’s next: Possibly bankruptcy.

- “The Company may seek alternative sources of equity or debt financing, delay capital expenditures or evaluate potential asset sales, and potentially could seek relief under the applicable bankruptcy or insolvency laws,” per its filing.

Brady Dale contributed reporting to this story.