Sorry, Ether: Sound Money Doesn’t Exist and Neither Does ‘Ultra’ Sound Money

Some Ethereum proponents sport a bat and speaker emoji in their name on Twitter. This means they support the idea that the Merge will make Ethereum “ultra sound money.” It’s sort of clever I guess, because bats use ultrasound to help them fly in the dark.

But what does that even mean?

To answer this, we first need to answer the question: What is ultra sound money? But before we can even begin thinking about ultra sound money, we need to start with just plain sound money. It is worth adding that sound money is sometimes referred to as hard money (which makes unsound money “soft”).

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Sunday.

The unsound euro and pound and (five) dollar milkshakes

A proper definition of sound or hard money is admittedly nebulous. A commonly accepted definition is this: a currency that serves as a reliable and stable store of value. By extension, sound money should preserve its purchasing power. If $1 gets me a milkshake today, it should get me a milkshake (or more) tomorrow, ad infinitum.

As such, unsound or soft money is exactly the opposite: a currency that does not serve as a reliable and stable store of value. The expectation of a soft money is that its value will change unpredictably and depreciate when compared with other currencies.

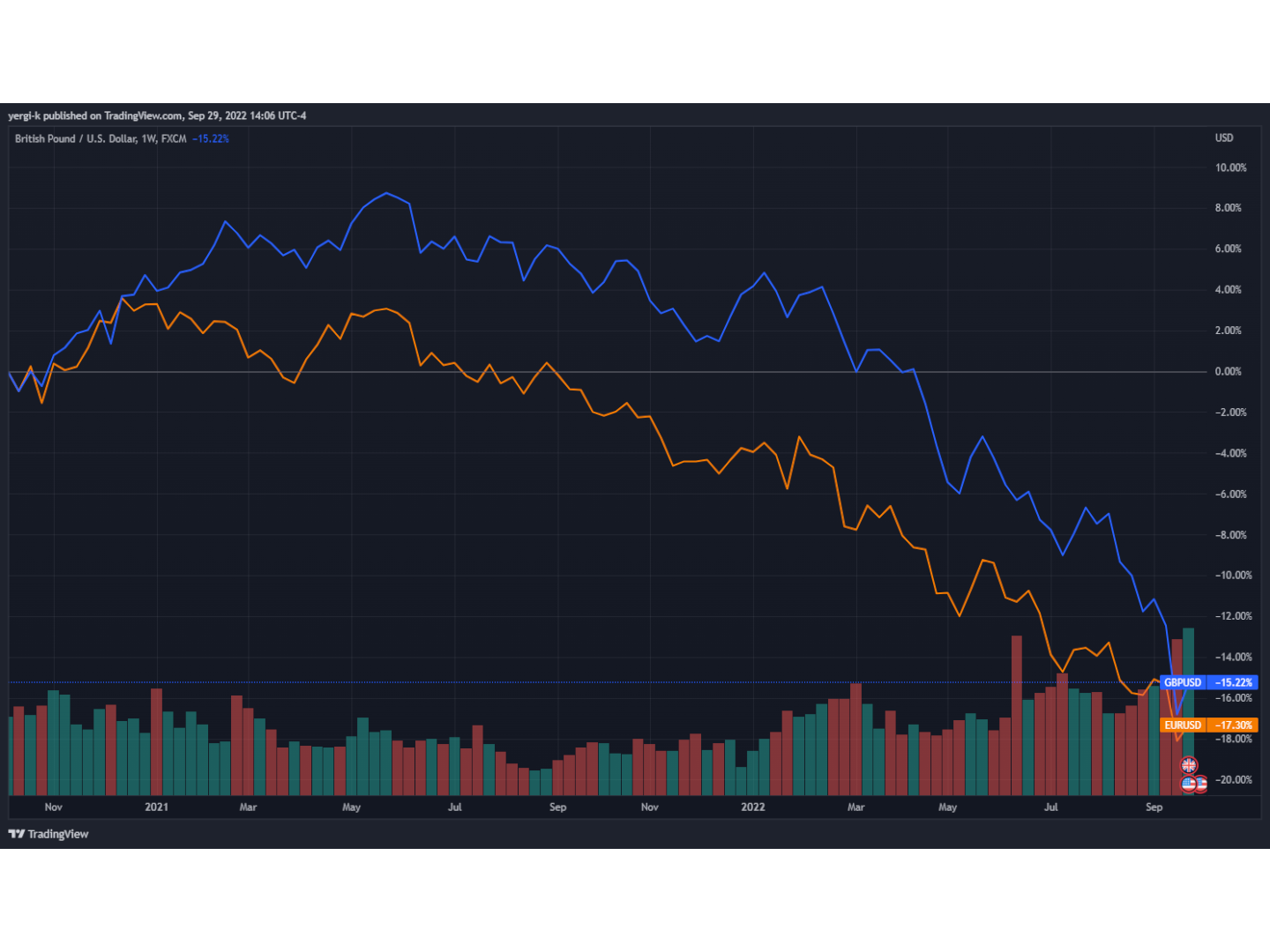

For an example of how unsound money might behave, we could take a quick look at the euro and British pound, both of which have lost more than 15% of their value compared with the U.S. dollar over the last two years.

Euro and pound versus the dollar (TradingView)

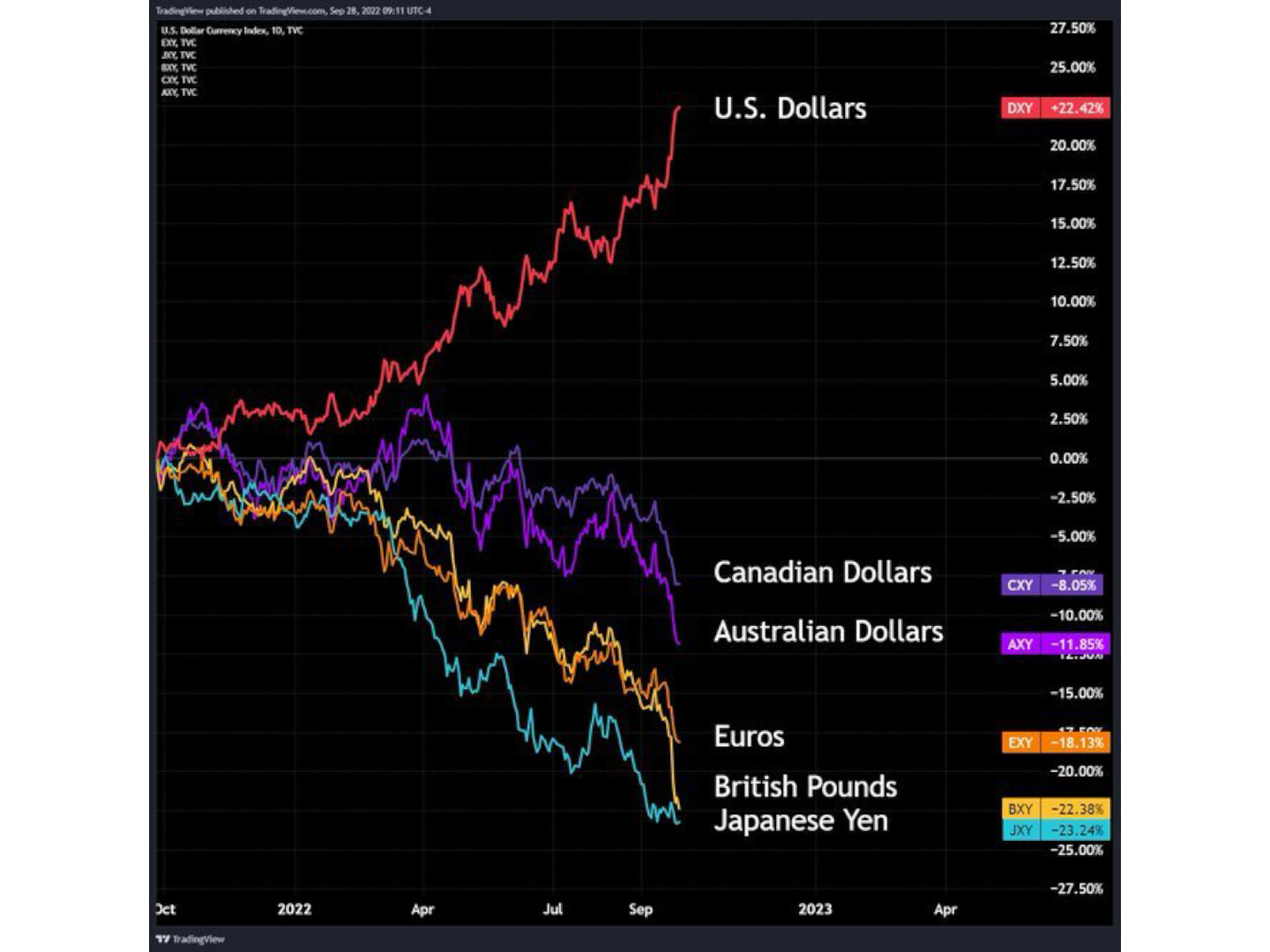

Maybe you can see where this is going? That’s right, straight to the Dollar Milkshake Theory. This theory (which I had never known until very recently) has percolated throughout financial media over the last week or so, using a chart that looks like this:

Currency strength over the last year (TradingView)

Here’s the skinny version of the Dollar Milkshake Theory: All debt-based fiat currencies will fall in value over time, but the U.S. dollar – as the world’s reserve currency and base of most financial debt – will fall slower than all the others, and all value will accrue to the dollar. As for the “milkshake” reference the dollar is like the straw in the other country’s currency milkshake, sucking up capital investment because of its reserve status.

Over the last year, that theory seems to be playing out, with the dollar outpacing the Canadian dollar, Australian dollar, euro, pound and yen.

With our current definition, we could say that the dollar is sound money. After all, it has appreciated against all the other major currencies.

The dollar hasn’t really maintained its purchasing power over time. Let’s stay on milkshakes and recall the famous scene from the 1994 cult classic movie “Pulp Fiction” in which a character is appalled that a milkshake costs $5 (even though it’s pretty good). The movie is set in Los Angeles. I don’t think you’d be too hard-pressed to find a $5 milkshake in Los Angeles in 2022.

Ether isn’t ultra sound money; neither is bitcoin

The thesis that ether is ultra sound money comes from two places.

First, it comes from the narrative that bitcoin is sound money because of its supply cap and its predictable issuance schedule (we know how many bitcoins there will be and how they will come into circulation over time). And second, it comes from the Merge adding a mechanism to the Ethereum network might lead to the supply of ether decreasing instead of increasing over time.

Because supply of ether is “capped” (it’s actually not technically capped, but issuance should be “net zero”) and the network might start burning enough ether such that its supply decreases, there is only one logical conclusion: If bitcoin is sound money, then post-Merge ether is ultra sound money.

None of those things mean that either bitcoin or ether is sound money. Sound money should reliably store value over time. Sure, maybe over the last five years bitcoin and ether have been wonderful stores of value, both up ~340%. But over the last year? Down ~53%.

BTC and ETH 5-Year Performance (TradingView)

A money is sound if the money stores value over time. Period. What sound money doesn’t mean is that the money has a fixed supply or a deflationary issuance schedule. No, it doesn’t matter that Bitcoin has a fixed supply of almost 21 million bitcoins or that we know its issuance schedule – if it doesn’t reliably store value over time, it is not sound money.

But what about gold? No, because ‘sound money’ needs to be money.

I openly admit that I don’t care about gold as a monetary asset. I actually think it’s quite terrible as money because it fails pretty spectacularly at being divisible and portable. But as much as it pains me to write, it might actually be our best example of sound money.

A saying I’ve anecdotally heard from goldbugs (for which I don’t have a reliable attribution) is that “an ounce of gold has always been able to buy a decent suit.” I don’t want to spend too much time proving if this true, but from my personal experience buying suits, I could have bought a nicer suit than I did if I’d spent the dollar equivalent of an ounce of gold instead of what I did spend.

But then again, how about buying literally anything else? How many ounces of gold should a cup of coffee cost? A Toyota Camry? A lamp? What’s more, you’d be hard-pressed to find any merchant accepting gold bars, gold coins or gold flakes for payment (except in edge cases like Venezuela). Also, how can you verify that the gold is in fact gold and not gold-plated copper?

As such, we should add two more characteristics to an asset to qualify it as sound money. It needs to be easily verifiable and widely acceptable, which gold isn’t. More plainly, sound money has to be … money. So sound money doesn’t exist right now.

And ultra sound money? No. No, that isn’t a thing either.