It’s / 3 posts found

It’s Moonvember ! Bitcoin Major Spike On Cards, Analyst Maps Potential High Levels

Cryptocurrency A bullish start of the month! During the last week of October the global crypto market cap moved past $1 trillion and since then the bulls are trying its best to maintain the mark. During the same time period the world’s first cryptocurrency, Bitcoin regained its key level of $20,000 pushing other currencies like Ethereum, XRP, Solana, Cardano among others. Currently, Bitcoin is trading at $20,628 after a surge of 0.61% in the last 24hrs and 6.74% over the last seven days. Immediate resistance lies around $20,650 and support is positioned at $20,550. Now, as the flagship currency is […]

Here’s Why It’s a Crucial Week For Crypto Market, What Bitcoin (BTC) Traders Can Expect?

Cryptocurrency Bitcoin bulls are trying hard to set their foot above the $24,000, although on the other hand financial analyst Justin Bennett said that this week’s release of inflation data will be the biggest test of the year by far for the cryptocurrency markets. The trader said in a new video that statistics from the Consumer Price Index (CPI) and Producer Price Index (PPI) might shake the macro environment and have a big impact on cryptocurrency. Both CPI and PPI will be released back-to-back the next week, so the stock market, as well as the cryptocurrency market, will want to […]

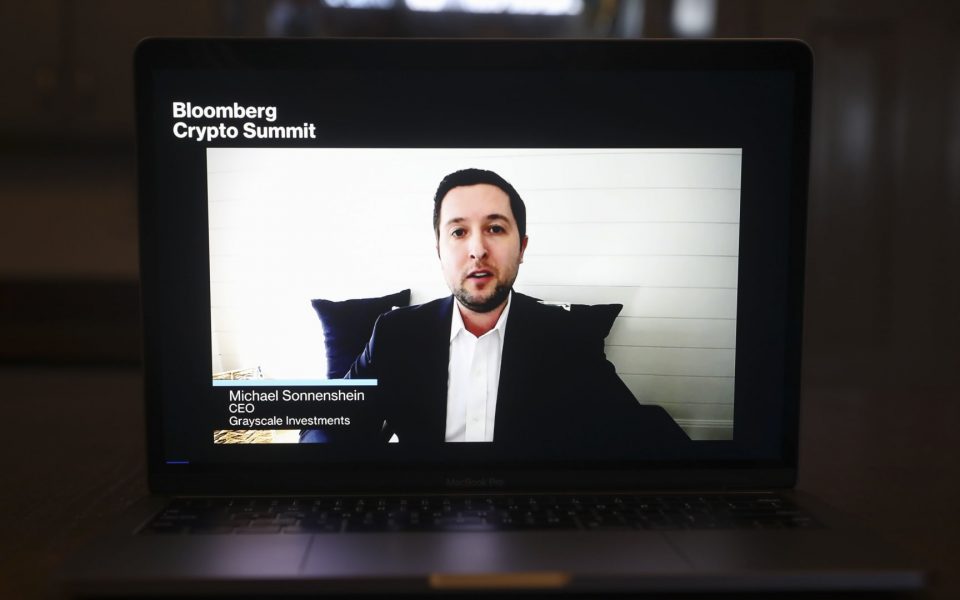

It’s a matter of when, not if, the SEC approves bitcoin spot ETF, says Grayscale CEO

Cryptocurrency Crypto experts are hopeful a spot bitcoin ETF could arrive as soon as this year. The optimism comes on the heels of the Securities and Exchange Commission approving an application for the Teucrium Bitcoin Futures ETF earlier this month. The fund was filed under the Securities Act of 1933, instead of the Investment Company Act of 1940, which other future bitcoin funds like Grayscale’s Bitcoin Futures ETF have used. “From the SEC standpoint, there were several protections that 40 Act products have that 33 products don’t have, but never ever did those protections address the SEC’s concern over the […]