The Pre-Bitcoin History You Should Know: Basic Cash Versus Fiduciary Media

Bitcoin

This is an opinion editorial by Matthew Mezinskis, creator of the “Crypto Voices” podcast and Porkopolis Economics.

Take a moment to reflect on how long you’ve been in Bitcoin. Now take another to ask yourself how many articles on money you’ve read along the way; And not just those medium-of-exchange or store-of-value pieces. Think about the philosophizing diatribes which purport to identify the mysterious meanings of what “money” is. And then the ultimate twist, how does Bitcoin fit in? Many words have been written by Bitcoiners, many by its detractors. From the “social contract theory” and “something we all agree on,” to the “transactional currency” and that ever-important “cup of coffee” metaphor, everyone always has something to say about money, and thus why or why not Bitcoin.

What about its investment implications? What about transporting the productive value of your labor — your savings — across spacetime? Sometimes people write about good money, sometimes they write about bad money. And lest we forget the fan favorite — never a dearth of chatter on this, how the money printer goes “brrrr” and what it means for our economy. There are more articles musing on money each year than Christmas markets in Vienna.

This piece is referenced from the author’s own monetary research, published quarterly, which tracks the supply and growth of base money in the world.

I’ll try to bring you something different here. Let’s go for it directly. The field of economics already has a category, a systemized classification, for what type of “money” Bitcoin is. I will tell you right now what it is, but you must understand, the backstory here is thousands of years old.

Ready? They call it “high-powered money” in the West. It’s referred to as “reserve money” in the East. Historically, it’s often called “base money.” In the global financial system today, we call it the “monetary base.”

There it is. That’s what type of money Bitcoin is, and that’s what type of settlement occurs when bitcoin trades hands, when UTXOs are destroyed and created anew. That is the economic label that completely encompasses what the Bitcoin network is and what it does.

Basic money is indeed a generally accepted medium of exchange. Sure. But again, that’s a different type of article. What basic money really is and why it matters is the story I want to tell you here.

What Base Money Is Not

This analysis will in fact be way easier if we start from the other side. We’ll get to what it is. But to start let’s look at everything in the financial system that is not base money.

What is not base money? Basic cash is not any medium of exchange that is controlled or issued by a third party. If there’s an intermediary involved — a bank or financial institution — then you can be quite sure the stuff you’re playing with is not base money.1 Another way to determine this is if you have an “account” with someone. Anyone. Any financial services provider. Do you hold an account with a bank? Then whatever is in it is not basic cash.

Right, some examples: The British and American systems have long been fans of paper checks. And I already know what you’re thinking. Besides being an application for fraud (you know, with your full name, address, and account number punched right on them), why should I even care about checks today? Well, I’m telling a story about money and banking here, so just know that checks once served a vital function in payments, and were instrumental in the growth of western economies, when there was zero or loose central bank oversight. Checks are actually way, way more profound than they appear, regarding innovations in moneyness. Anyway, back to what the thing is. Think about it. What else is written on a check? The payee’s name? Sure. But what else still? Who issued that check? Who actually came up with the thing? Is there an institution involved?

It is your bank, of course.

But tell me still. Whose idea was it to offer you those checks? Does it matter how big the checkbooks are? Who decides what the check looks like? Should there be specific quantities of checks that each bank offers its clients? Is there a check commissar sitting in every municipality, alongside the mayor, keeping a running tally of checks that process their way through the city? I mean we are still talking about money here, and checks have been used for hundreds of years … so this stuff necessarily must be run through the government, right?

Nope.

Exactly zero people told the bankers how many checks they could or should issue, and no one knows the (precise) answer to this in aggregate. All of this is still managed as it was 200 years ago, in a free market, where clients trust their banks (their intermediaries) to clear checks between one another, in order for everyone to make payments and facilitate economic growth.

So that’s a check. Definitely not basic money.

What about debit cards? I’m going to give you, dear reader, the benefit of the doubt by this second example, that you have already guessed that these monetary instruments are again, not base money. Yet again issued by a bank, these things are apparently cool for some folks; hotels like them and they’ve been around since the 1950s and the dawn of electronic banking … but they are basically plastic checks that are reusable, and clear quicker. And yeah, no one told the banks how many customers, or what kind of customers, to offer them to. The process has been fairly decentralized, for decades.

(Note, credit cards are actually a very different beast than debit cards, and in an important economic way when it comes to moneyness, but no time for that here. Still, credit cards are not base money.)

What next? What else do you use to pay for stuff? It’s probably time to talk about mobile apps and online banking. Maybe the fact that these things are digitally native—then they might classify as base money? Remember how to tell — the key is whether a third party is running the show for this product.

One example of using apps for purchases is Apple Pay. So it’s … Apple, right? Goldman Sachs, actually (ha-ha). Either way, a third-party institution is offering you that product, so it’s definitely not base money. Same goes for PayPal, Venmo, Skrill, Revolut, Wise, Paysera and all the other online-only banking apps and accounts. And for sure, you don’t need a bank account to use these types of services. Even if it’s just a payment processing company, that’s still a third party issuing those accounts. It means all those digital payment options are still not base money.

So that’s the main stuff, when we think of payments (stablecoins — we’ll get there!). You may understand that, besides the actual checks and cards themselves, besides the instruments, all of this is at the end of day linked back to your checking account or deposit account. Again, let’s leave credit cards aside for now. They’re even more distant “money.” But we also have other types of “accounts” in the financial system that nobody understands.

One is the savings account. This used to actually be a thing. Savings accounts used to (and in some countries still do) have more withdrawal restrictions than checking accounts. In return for this you’d receive a higher interest rate on your money deposited there. Not so today.

We also have time deposit accounts, which have yet further withdrawal restrictions and pay even higher interest than savings. Again, any base money in there? Nope.

We have other old school instruments like money market funds. These are typically not insured by the government, should pay a higher interest than checking deposits and trade more like a stock (one share should be around one native currency unit) if you want to get them. Base money? Again, surely, no.

So let’s rehash, and please note this applies regardless of retail or institutional nature:

- Checks, debit cards and mobile apps linked to deposit accounts are not base money.

- Credit cards are definitely not base money.

- Savings, time deposits, money market, and other interest-bearing accounts are also not base money.

Alright, hopefully that was a semi-productive exercise in hashing through all the monetary instruments that are not basic money but are still used for payments. And for a while now you may have been asking, “So, what are these damn things actually called then?!”

Answer: Fiduciary media.

This is an important term. It’s crucial. And the most logical of names. I’m not asking you to become an economist here — please don’t — but what I hope you do realize is that all the typical stuff we think about and use as “money” in our current financial system is economically referred to as fiduciary media.

It’s a claim. It’s an IOU. It’s a token.

It’s money in a “moneyness” sense, but it’s not money in a “base money” sense.

“Again, what?”

It means exactly what we’ve been talking about. Fiduciary media is simply not basic money, and if you own such a claim, you don’t own any basic money! Yet when you hold this claim, you don’t hold “nothing.” This fiduciary media can and does circulate freely and is used for payments.

Bitcoin, Briefly

If I asked you now, is bitcoin base money, what would you say? It’s not a trick question. Don’t think too much.

I hope you answered yes. Bitcoin isn’t issued by third parties. To acquire it, to hold it, I don’t need a third party at all. I could mine it. The native unit bitcoin, equaling any number of UTXOs, have no reliance on any fiduciary whatsoever. It is a base asset that you can acquire and hold by yourself, Requiring no permission, no intermediary. What about the big miners? Miners do provide a service in producing blocks, and their costs in the aggregate are expensive today, but this expensiveness shouldn’t be thought of as “required” by the system. If all miners left, difficulty would adjust, and obtaining new bitcoin would be a less “expensive” proposition than it is today.

But crucially, other than bitcoin, everything else in the financial world described above is fiduciary media. It’s fine to call it money, but if you want to know exactly what it is in an economic sense, it’s simply called fiduciary media. If you’re waiting on your salary to be direct-deposited into your bank account, or you’re waiting on a check to clear from your account to your payee’s (really, you still are?), then you’re waiting on a financial intermediary to act on your behalf. You’re using fiduciary media to settle debts and make payments.

“So brass tacks: Are you saying fiduciary media is bad?”

Nope.

“Are you saying it’s a fraud?”

Nope.

“Are you saying it causes bad macro things to happen economically?”

Nope.

“But still you’re saying fiduciary media is a type of money?”

Yep.

“And most importantly, fiduciary media is not basic money?”

Yes.

In all my speeches on money, I find the above points are hardest to grok. I get it. In your daily routine all you really care about is how the card, check or banking app looks and behaves. You want it to work. Fine. But the important questions I’d like you to ask yourself after reading this are ones like, “Who issued your card?” “Who issued your account?” “Who processed that payment on your behalf?” “Who is your fiduciary?” If you can think about these instruments in these terms, then you’ve won the battle, and you know more about money than most economists. It’s really not more complicated than this when it comes to what fiduciary media is and base money is not.

As to the “why” of fiduciary media, this should be self-evident. The purpose of fiduciary media is this: Institutions have issued these claims throughout the centuries (and still do so today) in order to facilitate payments, as traditionally they are more efficient in doing so than base money.

“Hold on though, are you sure fiduciary media doesn’t cause bad things to happen in the economy?”

Yes I’m sure, but as always, the big asterisk is this: As long as central banks are not involved. We will come back to this.

The main takeaways for now are that fiduciary media isn’t basic cash, fiduciary media is good for payments, and it’s also not inherently bad, nor fraudulent.

Base Money

So if you’re using a check or plastic or their digital equivalents on your phone, issued and managed by a private bank, then you are using fiduciary media. You are not using basic money. After all that, I’ll try and keep this short as to what base money is.

If you simply intuited that base money would be the opposite of fiduciary media, this assumption will get you pretty close. What forms of money do we have in the marketplace that aren’t managed by a (monopolized) third party? What forms of money are assets of ultimate settlement, where you don’t have to rely on anyone else to settle? What form of money is supplied by the market, due to its demand to be held as a store of value and medium of exchange?

History has only illustrated two long-lasting forms of basic money. One is silver, and the other is gold. These aren’t the only two. Certain shells (specifically cowrie shells and wampum) came close in certain times and places, but didn’t make it worldwide, nor prove long-lasting. Nick Szabo has written wonderfully about the history of beads and shells as primitive money, highlighting the important role these collectibles played for millennia.

Gold and silver are the deepest, most balanced, and most documented instances of base money that achieved worldwide adoption. As far as coinage goes, silver has long been historically documented as the first mover from ancient times, and gold rose to prominence later, roughly from medieval times.

But Why Base Money?

My reading of history as to the “why” for basic cash is twofold. Both reasons applied throughout the centuries and both still do today. However, depending on where you live (likely a Western country if you’re still bothering to read this English), these two reasons might not be obvious.

The first reason base money is needed is during a “non-local” trade situation. You, as one party to the deal, may never see your counterparty again, and you need the cash before moving on. Take a European spice trader in the East Indies or a rum trader in the West. When the deal is done, he’s getting back on his boat to Europe, and at best he doesn’t see these people again until next season, if ever. He needs to settle the deal before he leaves port. Enter gold and silver. A global medium of exchange that works abroad, and works at home. Obviously, the entire deal doesn’t need to be done 100% in gold; it could be 80% in goods, and then 20% settled in gold or silver on the margin. An early episode on our podcast with Dr. George Selgin covers this phenomenon well.

The second basic reason for basic money is the store of value function. But not just store of value in the generic sense; rather, in a very specific and personal one: the heirloom. Heirlooms allow for the transporting of your life’s savings to your children. Yes, as humanity develops, we’ve been able to transfer on other goods besides money to our heirs, such as fine art, property or even a portfolio of stocks; however, those examples typically rely on a legal system, and (here’s that word again) a fiduciary. This reason for basic cash alludes back to the Szabo article on everything from shells to heirlooms and collectibles with deep and certain value transfer. Gold, jewelry and silverware still fulfill this role today. Dowries and inheritances are huge in the developing world, in particular India and China.

That’s the “why” for basic cash. Now, let’s begin to take a hard look at what it actually is.

Gold And Silver

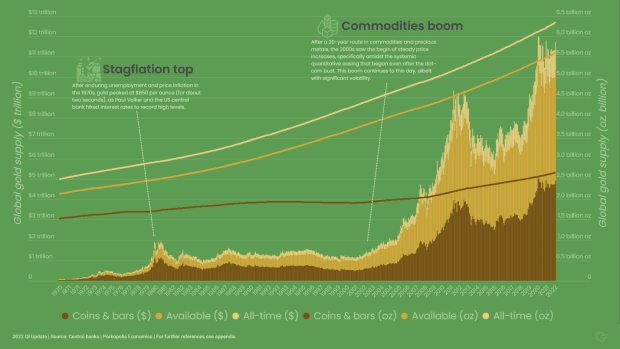

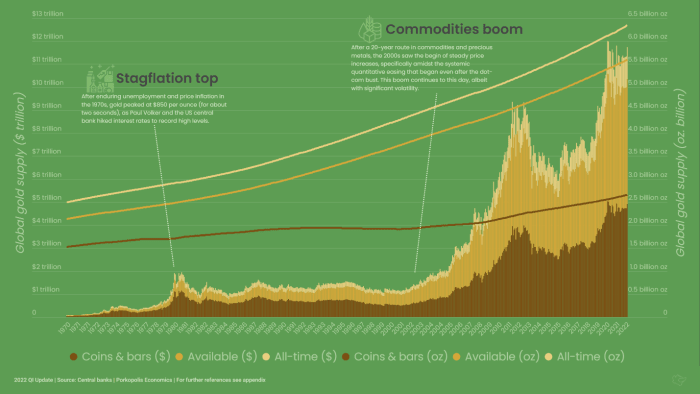

Even a child knows that gold and silver have something to do with money. Whether it be from video games or fairy tales, it’s ingrained in our DNA that these metals are precious. I’m going to show you their supply curves right now. Here’s gold, over the last 50 years:

Unfortunately, this picture is not a part of our most basic financial education. It should be. You can verify my numbers from many industry and mining publications, though finding the exact format and figures will be difficult as again, for some reason this stuff is never explained simply. Note there’s going to be a margin of error in what you see modeled above, versus reality (or other research). No one knows exactly how much gold has been produced, but these are my figures and I’m sticking to them.

Another issue is that the industry typically quotes gold units mined in metric tonnes, which is a horrible thing to do. They should always be displayed in the native units that the marketplace quotes for price, which is “per troy ounce.” Why should we do it any other way? As with many things in life, don’t let CNBC or Bloomberg confuse you on what’s relevant. In the chart above, the right-hand side measures mined gold in billions of troy ounces, and the left-hand side displays the amount of mined gold expressed in the current global unit of account: the U.S. dollar.

Throughout all of humanity, we’ve pulled 6.3 billion ounces of gold out of the ground. At current prices that’s roughly $11.3 trillion in value. Does it mean that if the entire world sells its gold right now, they would and could get $11.3 trillion (if they desired)? Obviously not, but we’ll get to that.

6.3 billion ounces is actually 60% more than 50 years ago, meaning that nearly two-thirds of all gold throughout history has been mined since 1970.

But not all of that gold comes in the form that we typically think of from fairy tales; namely, in bullion form, in coins and bars. 12% of this is deemed to be “lost or consumed” by industry, from where it isn’t easily recovered. Of the gold that remains, about 50% of it is in jewelry form, and 50% of it in the form of coins and bars.

Nonetheless, we can think of all jewelry and bullion as gold that is liquid and global. Isolating again the value that’s lost to industry, we get about 5.6 billion ounces, or $10 trillion equivalent, at current prices.

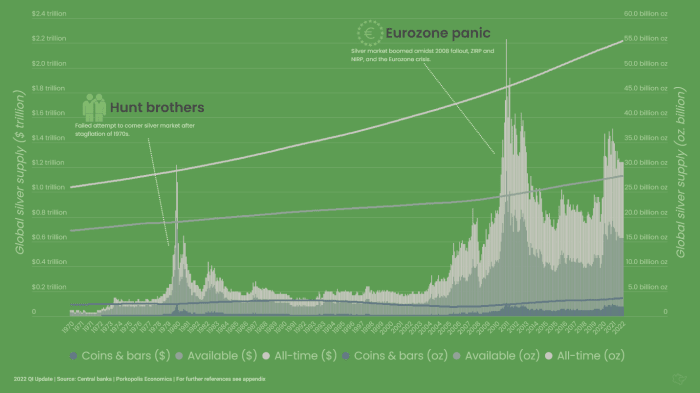

Here is the exact same type of graph, yet now for silver. Some 55.3 billion ounces of silver have been mined throughout humanity. Similar to gold, the majority (53%) of all silver above ground has been dug up since 1970:

Though silver preceded gold in the past as a mostly monetary (coinage) asset, today it’s a different animal on a macro level. A much larger chunk of its mined supply has gone into industry and deemed not easily recoverable. 27 billion ounces strong in fact, or $600 billion in equivalent value, is lost. This silver sits in technological devices, in conduits, in machinery, and in buildings. The demand drivers for silver today are much more industrial, and much less monetary and ornamental than gold.

Now of the non-industrial silver above ground, it’s even more different from gold in that only a small fraction of it is in bullion form (coins and bars), only about 3.6 billion ounces, or $80 billion worth. But even if we called that silver “monetary” silver, we should still consider all the other wealth-transferring, liquid silver above ground. There’s about 24.6 billion ounces of that stuff, $550 billion worth at today’s prices. And a large portion of that includes not only jewelry, but your grandmother’s fancy silverware.

Now without getting much further into the weeds here, let’s ask ourselves some questions about this gold and silver stuff that is liquid, ornamental and monetary:

- Gold: 5.6 billion ounces ($10 trillion equivalent)

- Silver: 28.2 billion ounces ($610 billion equivalent)

If I hold some of this personally, in my home, is it definitely “mine?” Yes. Would it classify as an “asset” on my own personal balance sheet? Yes. Can I transport this wealth into the future by passing it down to my heirs? Yes. Did any company “deem” these metals into existence? No.

The answers to the above questions, alongside the obvious demand-tendencies for them throughout human history, as well as their exchange-medium function, can only lead us to one economic conclusion. The chemical compounds of aurum and argentum are basic cash. They are classifiable as basic money.

Closing The Loop

The distinction that matters is that of basic cash, versus fiduciary media. Before you get to the benefits of one, versus the risks of the other, not only does it help to know the mechanics, but also to know that we really can zoom out sufficiently and look at how both of these things interplay in the global financial system.

So far, we’ve looked at what fiduciary media actually is in the modern financial system, and why it matters. We’ve taken a good gander at historical basic money, which is gold and silver. We’ve talked about why that matters. We’ve briefly looked at why bitcoin also classifies as basic cash, with similar (albeit superior) qualities to those of gold and silver.

In Part 2 we’ll close it out. We’ll visit those goldsmiths and money traders in the old days of the gold and silver trade. We’ll see how fiduciary media developed here, and began to represent the demand for gold and silver. This will bring us into modern banking. Along the way we’ll certainly need to scan the inevitable reach of the sovereign, of the state, around all this. Remember, as the wonderful Ron Paul simply observed, “Money is one-half of every transaction.” It’s impossible that the state would not ogle and then move in on the money market.

I’ll also put a little more color on this term “moneyness.” Money is a word that straddles “basic cash,” “currency,” and “fiduciary media,” often without a second thought by its speaker, so we need to do some work there.

The rise of the modern central bank will be impossible to ignore as well. I always say I’m not sure which is the husband, and which one is the wife, but it is undeniable that the most profitable marriage of all time is that between a nation-state’s treasury, and its central bank.

And that will bring us to the modern, fiat monetary base. And certainly not just a passing description of the lazy economist, I’ll show you exactly what it means, and exactly what it looks like.

And then of course we’ll see how all roads lead to Bitcoin. Why bitcoin is basic cash like that of yore, and why this time, it may be different.

This is a guest post by Matthew Mezinskis. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.