Market Wrap: Bitcoin Heads for Best Week in 3 Months

Cryptocurrency

Bitcoin (BTC) rose Friday after a U.S. government report showed the Federal Reserve’s preferred inflation gauge rose slower than expected last month. The reason that matters is because it shows progress in the Fed’s campaign to tamp down the pace of price increases, in turn signaling that it might be able to let up sooner rather than later in tightening monetary policy – seen as a negative for prices of risky assets, from stocks to bitcoin.

The oldest cryptocurrency’s push past $20,000 has turned the market mood more bullish. Bitcoin’s 5.6% gain since Sunday represents the biggest weekly gain in three months. But the crucial test will come next week when the Federal Reserve’s Federal Open Market Committee meets. Most traders expect the U.S. central bank to raise the main interest rate by 75 basis points (0.75 percentage point), but the drama is likely to come from whatever Fed Chair Jerome Powell signals about the committee’s plans for its December meeting.

The CoinDesk Market Index (CMI), a broad-based market index that measures the performance of a basket of cryptocurrencies, recently rose 1.8% over the past 24 hours.

In traditional markets, the Standard & Poor’s 500 rose, with tech stocks boosted by an encouraging earnings report from Apple.

Among crypto stocks on Friday, shares of bitcoin miner Core Scientific (CORZ) tanked after the company warned it may have to explore bankruptcy.

●

CoinDesk Market Index (CMI): 1,018.27 +0.4%

●

Bitcoin (BTC): $20,646 +0.8%

●

Ether (ETH): $1,562 +2.0%

●

S&P 500 daily close: 3,901.06 +2.5%

●

Gold: $1,648 per troy ounce −0.8%

●

Ten-year Treasury yield daily close: 4.01% +0.1

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Bitcoin, Ether Press Higher as Momentum Increases

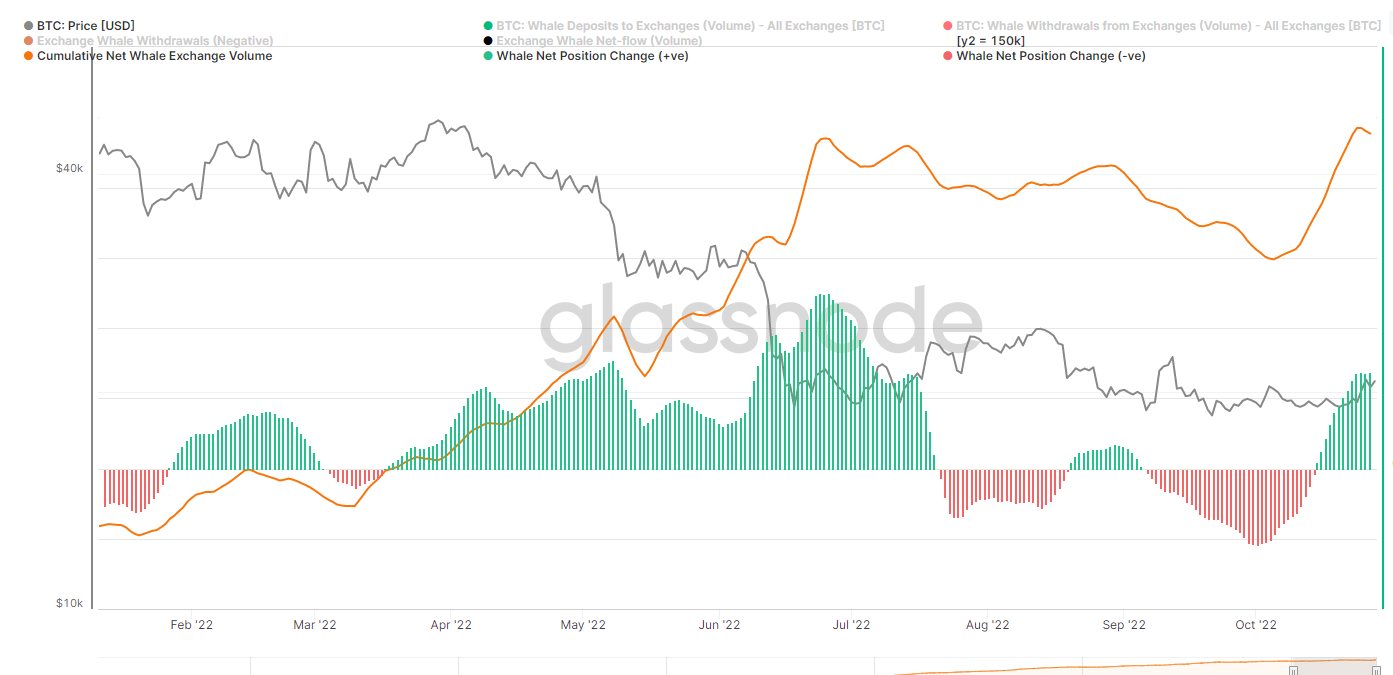

“Whale” movement of BTC to exchanges (Glassnode)

Investors should also weigh on-chain analytics to ensure they are adopting a measured approach. Over the past week, large BTC holders have been moving coins to exchanges.

For investors with a bullish outlook, this isn’t the best sign because coins are often moved to exchanges to ready them for rapid sale.

However, this trend may just be a preventative measure ahead of Nov. 10 consumer price index data. Still, the move to exchanges appears to have stabilized as of Oct. 25.

-

Stablecoin Issuer Frax Finance Unveils Ether Staking Service With a Dual Token Model: The model will simplify decentralized finance integrations and supposedly allow users to earn above-average ether staking yields. Read more here.

-

NFTs Are Going Big in Latin America Amid a Crypto Boom: With an increasing number of financial and political crises in recent years, Latin American citizens have found in crypto a powerful tool to cope with the instability. Now, non-fungible tokens (NFT) are booming in the region, with the goal of solving real problems and not speculation. Read more here.

-

Listen 🎧: Today’s “CoinDesk Markets Daily” podcast discusses the latest market movements and a look at a hilarious way to get served.

Biggest Gainers

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk Market Index (CMI) is a broad-based index designed to measure the market capitalization weighted performance of the digital asset market subject to minimum trading and exchange eligibility requirements.

Sign up for First Mover, our daily newsletter putting the latest moves in crypto markets in context.

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.

DISCLOSURE

Please note that our

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

which invests in

and blockchain

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.